Open Enrollment

U.S. healthcare paycheck contributions grew by 9.7% in 2020, reaching an average $12,530. This does not include out of pocket costs like copays and deductibles!

Open Enrollment is typically the one time of year the majority of Americans are allowed to make a change to their medical insurance coverage. Choosing the best option, sometimes between options from multiple employers, is a confusing and frustrating experience which we must deal with every year. What coverage you choose is very important, without a qualifying life event you will not be able to change your mind until the next annual open enrollment period.

And according to the census.gov website in 2020, 87% of full-time, year-round workers had individual or employer-sponsored healthcare insurance. There are many reasons why a person covered under an individual or group-sponsored health plans should consider making a change in their enrollment. Only about 17% of these insured persons changed their health plan during the year prior. Another survey suggests less than 50% had made a change in the last three years. Despite changing medical needs and costs It’s just too confusing and frustrating to research each option every year.

As the cost of care increases, insurers raise premiums and the average cost of both single and family coverage rose about 4% in 2021, essentially matching the 5% average adjustment to workers’ wages. The good news is that you don’t have to be stuck with a more expensive plan. When we talk about the cost of healthcare it is important to review your personal health and financial situation and be willing to adjust your health insurance to the most appropriate level for your personal or family needs.

Other considerations are that your current treating providers no longer accept your insurance, the plan you have today is not being offered at the next Open Enrollment. However, the cost of your coverage and appropriate access to the providers in comparison to your annual compensation loom large.

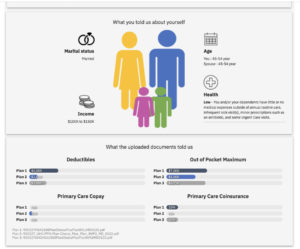

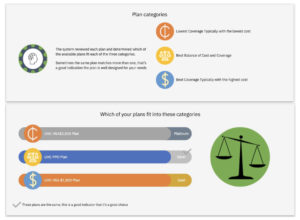

Aceso Y! was designed to support you in making these all too important high-cost annual decisions with less frustration and confusion, ultimately leading to a less stressful experience with a higher degree of confidence that you and dependents have the best coverage in place for the personal care needs and financial ability.

Click here to compare your plans and find the most appropriate level of coverage based on your usage and financial needs.